is colorado a community property state for tax purposes

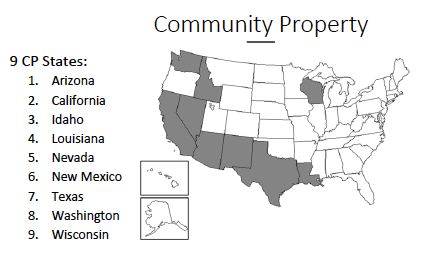

Colorado is an equitable distribution or common law state rather than a community property state. Arizona California Idaho Louisiana Nevada New Mexico Texas Washington and Wisconsin are community property states as is Puerto Rico.

Income Tax Topic Part Year Residents Nonresidents Department Of Revenue Taxation

Thus as a general.

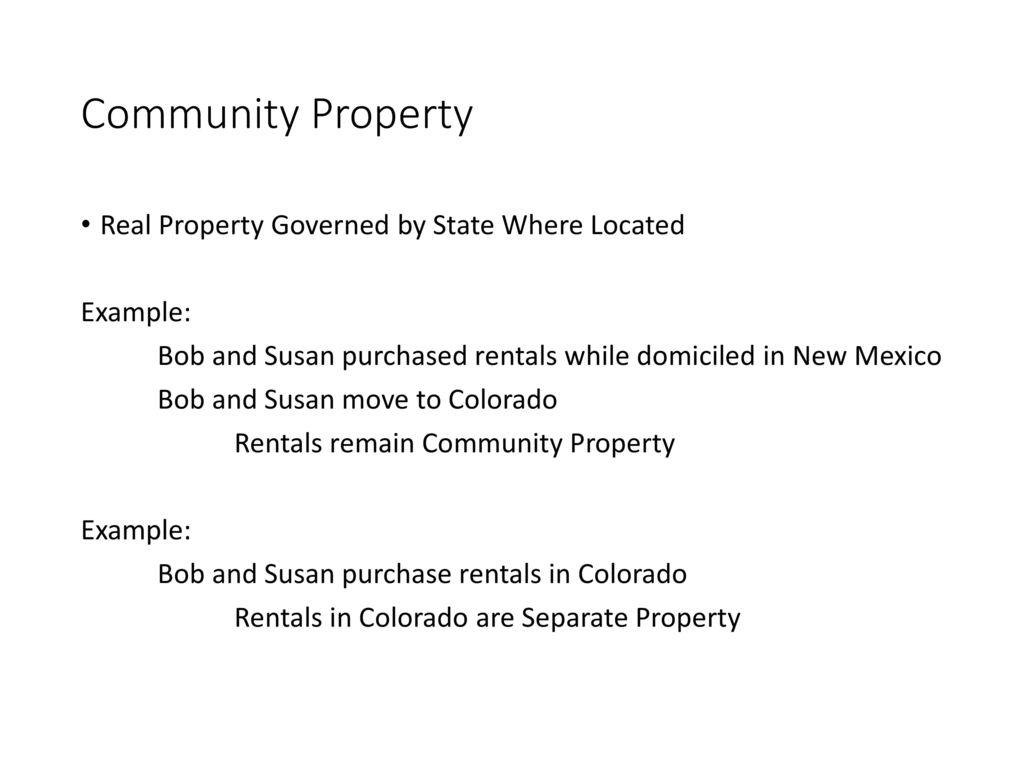

. Colorado is a common law state not a community property state which means that each spouse is a separate individual with separate legal and property rights. In the case of a part-year resident any income that relates to that part. Colorado is not a community property state as courts do not assume that the property obtained during the course of a marriage is all marital property.

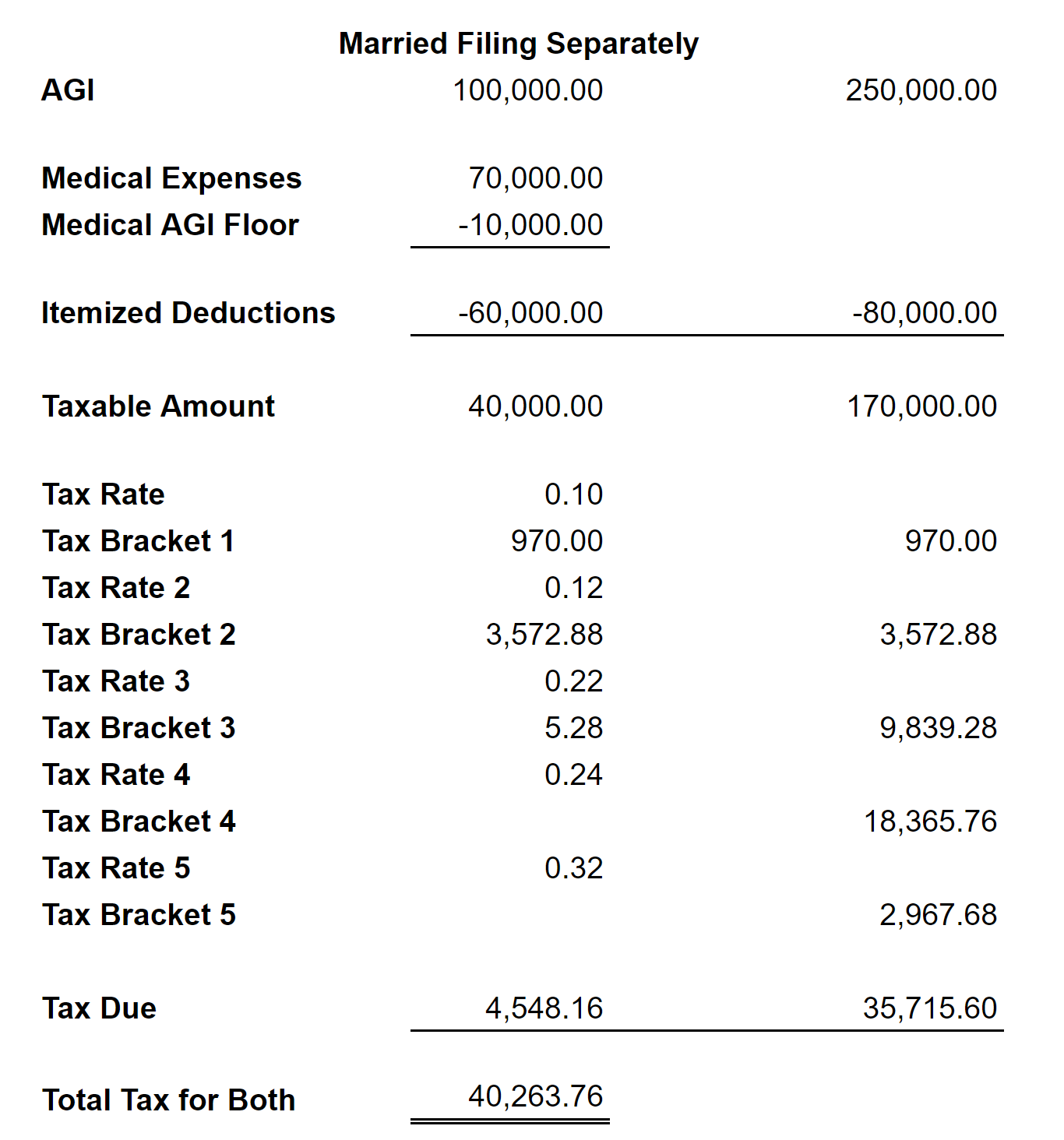

Colorado is not a community property state but it does have a category called marital property in colorado most assets acquired during a marriage are considered marital. For income tax purposes if spouses file separate returns each spouse is taxed on 50 of the total community property income regardless of which spouse acquired the. If your spouse earns 1000 this week 500 of.

Colorado remains an equitable division and dual-property state. First installment of tax bill due. The conflict between the federal rules governing IRAs and state community property rules recently came to light in a private letter.

Colorado is not a community property state. Colorado State Sales Tax. 14 Is Colorado A Community Property State For Tax Purposes Pictures The intent to establish a domicile is essential in the determination of a persons domicile.

If you own a home in the Centennial State you pay 063 of your. Arizona california idaho louisiana nevada new mexico texas washington and wisconsin are community property states as is puerto ricothe state of alaska allows. In general any part of a nonresidents income that is derived from Colorado sources is subject to Colorado income tax.

Based on current state tax rates this. Personal property declaration schedules for centrally assessed property are due. Sales tax in Colorado starts at 29 but each county or city can charge more if they want to up to 83 additional tax.

The state of Alaska allows couples to. Is Colorado a Community Property State for Tax Purposes In some states the conjugal union ends when the spouses separate permanently even if there is no formal agreement. The low percentage of property taxes compared to the total revenue collected indicates a state with low property tax rates.

Community income is generated by community property as well as the full earnings of each spouse during the marriage. Division of Property Taxation 1313 Sherman St Room 419 Denver CO 80203 Phone. Understanding Equitable Division Under Colorados Revised Statute Section 14-10-113 the state must first.

Personal property declaration schedules for locally.

State Local Tax Burden Rankings Tax Foundation

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

Trusts And Community Property States Taggart Law Llc

Community Property Taxation Laws Ppt Download

Can A Married Person File Taxes Without Their Spouse

How Do Marijuana Taxes Work Tax Policy Center

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

Division Of The Marital Estate Colorado Family Law Guide

How Taxes On Property Owned In Another State Work For 2022

Spouses Who Live In Different States Face State Income Tax Problems

Five Tax Tips For Community Property States Turbotax Tax Tips Videos

What Is Form 8958 Allocation Of Tax Amounts Between Certain Individuals In Community Property State Turbotax Tax Tips Videos

Deducting Property Taxes H R Block

Property Tax Calculator Estimator For Real Estate And Homes

Is Colorado A Community Property State Johnson Law Group